My Journey from Tradfi to Web3

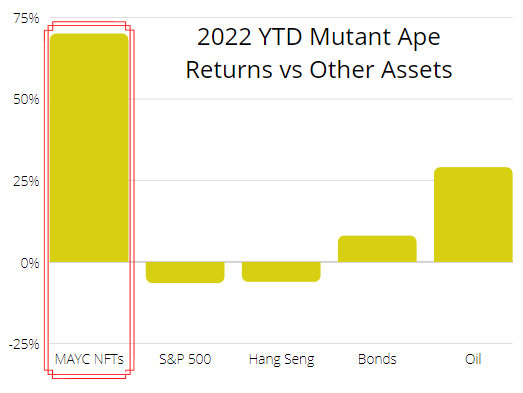

Two books published three years apart completely changed my life. The first book "Liar's Poker" was published in 1989, and the second book "Snow Crash" was published in 1992. Unbeknownst to me, I would spend eighteen years of my life imitating the first book. And now, with a bit more self-awareness, I'm trying to live the fantasies of the second book.

Living Liar's Poker (Age 18 - 36):

I read Liar's Poker in my senior year of high school. It was a cautionary tale against the greed and the excesses of wall street. However, much to the surprise of author Michael Lewis, it became a best seller and fueled the next generation of eager masters of the universes.

I was one of them. I joined finance in the hay days before the financial crisis. Investment banks were at the heights of their power and prestige. Even lowly graduates like myself started their career with a business class flight to elite boot camps in London or New York, before being shepherded back to Hong Kong.

I thought the trading floor was the most exciting place in the world, the cutting edge of finance and world events. Not to mention the pay was unbelievable for a fresh graduate. My comp included USD 65K of base salary, USD 24k of expat housing allowance, and 6-12 months of bonuses. Making 6 figures before the era of QE was actually life-altering money for a kid out of college.

It was awesome.

Life was so good that I barely noticed the ensuing financial crisis that started in 2008. We continued to make deals during the day and partied during the night. Sure; a few of my friends lost their jobs, but most of us were too junior to be affected. Life went on. Over the next 15 years, I managed to work myself up from a lowly analyst to a hedge fund manager in charge of a team of analysts that oversaw almost a billion dollars of capital. The pinnacle of my professional life.

Then I quit.

Living Snow Crash (Age 36 - ∞):

Never in my professional investment career would I have thought I would spend more than 70 thousand US dollars on a JPEG. But here we are. The above JPEG is owned by yours truly. I call him the Mutant Asian Ape.

But why? I was a respected member of a fraternity of pedigreed investment professionals. And instead of stocks and bonds, why am I telling friends to buy digital pictures of monkeys?

It goes back to the second book that changed my life. I read Snow Crash only a few years ago, and I didn't fully appreciate it until I re-read it recently. Unlike the non-fiction Liar's Poker, Snow Crash is a science fiction tale of the future where humans lived in the real world as well as in the "metaverse", a term that was coined by author Neal Stephenson for his 1992 novel. Thirty full years before Facebook Meta caught on.

The "metaverse", as described in Snow Crash, was a computer-generated world. In the metaverse, people lived lives through their digital identity, owned their digital assets, and lived lives that co-existed but were also separated from the real world. The main character worked as a pizza delivery boy and lived in a shipping container in the real world. But in the metaverse, he was a famous elite hacker on a mission to save the world.

What Stephenson imagined 30 years ago is now becoming reality with advancements in technologies such as crypto and blockchain. I admit, when I first bought a tiny bit of Bitcoin in 2017, I had no idea that it would lead to web3 and metaverse in 2022. I just thought crypto was a good investment from a risk/reward perspective.

But as I dug deeper into the crypto rabbit hole, I realized that web3 is much much bigger than just crypto. Web3 is creating a parallel world where the rules are not bound by earthly institutions or even physics. With code and decentralization, an alternate world is being built that could take human creativity and civilization to the next level of advancement.

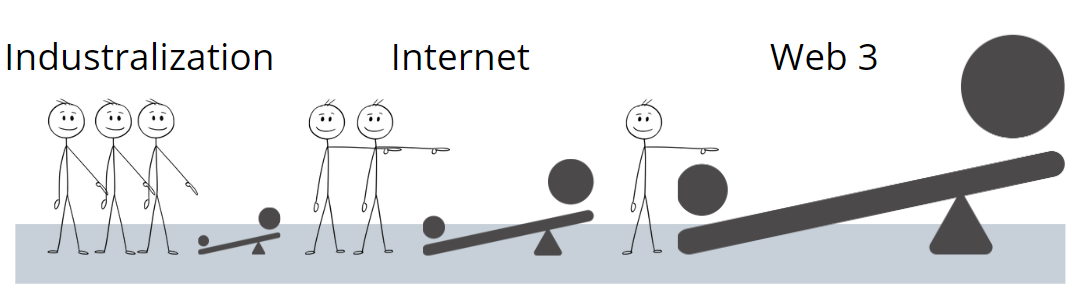

Archimedes famously said: “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” I believe that technology is just a way to leverage and magnify human potential. And Web3 is the latest and the greatest lever humans have seen so far.

Already the lines between the real world and the digital world are blurred. NFTs carry million-dollar tags and are prized by many as their core identities, even more important than their real-life names. DAOs are now formed by total strangers who've never met in real life, all collaborating and building. Computer programs written by a handful of coders now live on the blockchain independently and underpin billion-dollar transactions.

I left my tradfi job only in 2020. So versus many, I'm a little late to the party to go "all-in" web3.

But I believe we are still very early. Web3, like blockchain, is a multi-decade trend and will change the world in our lives in ways that we can't even imagine. NFTs are your passports into Web3. It's the ticket to the show. Perhaps the greatest show yet.

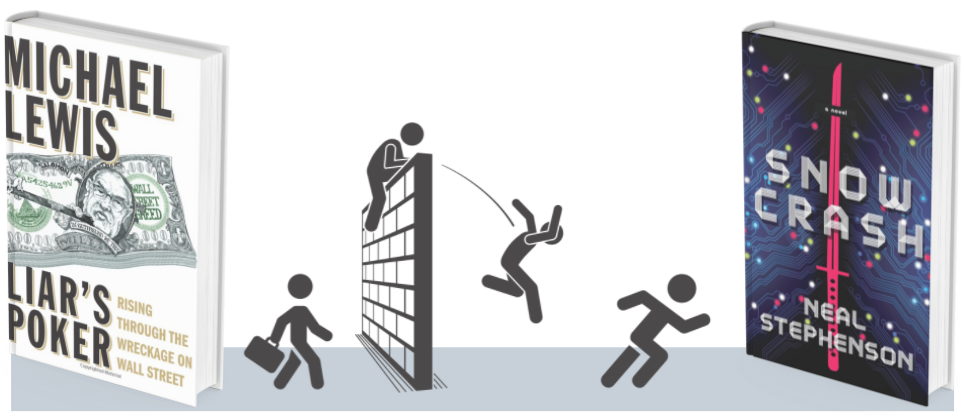

Of course, I've been drinking the kool-aid hard, so aside from the philosophical babbles, financial savvy readers should sense a paradigm shift just by looking at the year-to-date performance of the below assets in a rising rate environment. If it's just a bubble, why are NFT prices still going up as Fed hike rates? Topic for another time..